THE BIG MAC INDEX 2024 TABLE – THE ECONOMIST

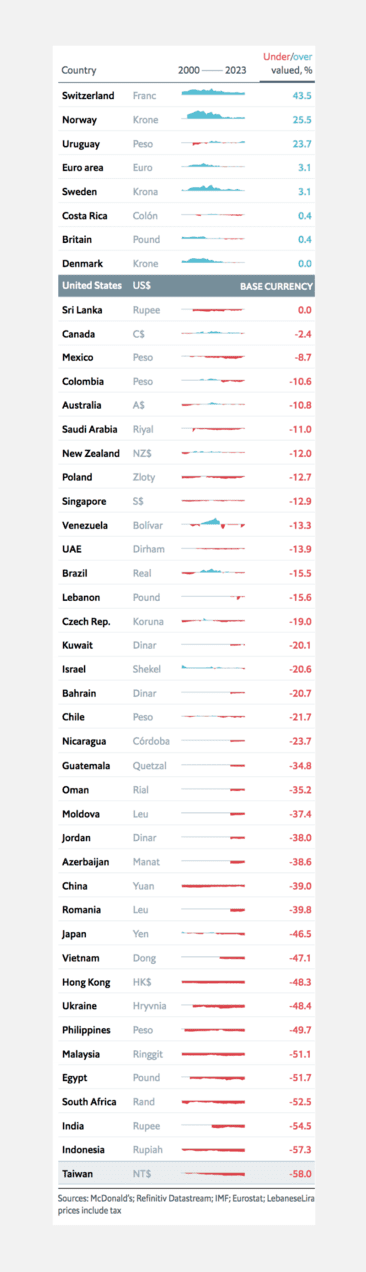

The Big Mac Index 2024 Table by The Economist. Complete Big Mac Index chart by The Economist January 2024. Free download graph.

Brought to you by Mau, a Senior Digital Marketing Specialist at eDigital.

THE BIG MAC INDEX 2024 TABLE – THE ECONOMIST

You told us: the Big Mac Index scrolling table on The Economist website sucks big time.

That’s why you can find above the same Big Mac Index 2024 table but with no scrolling.

Save this table and share it with your colleagues.

THE 2024 BIG MAC INDEX CHART – THE ECONOMIST

Big Mac Index 2024 The Economist table chart

Marketers are comparing this table with > The Big Mac Index table 2023, 2022 and 2021

WHAT IS THE BIG MAC INDEX?

The Big Mac index tries to show whether countries’ currencies are at their correct level by comparing the price of a McDonald’s Big Mac in different countries. In order to get purchasing power parity (PPP), a currency value should move towards the exchange rate that would equalise the price of a Big Mac hamburger in the USA.

Related: The new McDonalds’ logo PNG

THE TOP BIG MAC INDEX ALTERNATIVES

- A Bread loaf. Some countries do not really eat that much bread so it won’t work as well as the Big Mac.

- An iPhone 7. The iPhone 7 is currently the most used phone in the world, however, as it is an old model, prices fluctuate depending on where you buy it: Facebook marketplace, black markets, etc. It will not work as well as the Big Mac.

- A Starbucks coffee cup. A cup of coffee from Starbucks is a similar item but it will not dethrone the famous Big Mac index.

Marketers are comparing this table with > The Big Mac Index table 2022 and 2021

CONCLUSION

The Big Mac index can offer marketers a good insight to take into consideration when crafting their pricing strategies when crafting the best go-to-market strategy template.

If you are an Australian company planning to launch a product or service in a country with an overvalued exchange rate (i.e. The U.S.A), you could deduct that the overall costs for selling to American consumers will be higher than in Australia while you will also have room to charge higher to them.

On the contrary, you may decide to sell your Australian goods in a country with an undervalued exchange rate as long as the predicted demand (quantity sold) for your product is far higher than the exchange rate disparity. That could be the reason why McDonald’s USA continues selling Big Macs in undervalued currency markets as the demand (quantity sold) is bigger than in the domestic market (USA) while potentially maintaining or even increasing profit margins.

Surely there are many factors that affect the disparities on this Big Mac index such as the costs of labour, price of ingredients, rental, logistics, security, taxes, inflation, etc.

eDigital can help you conceptualise, plan, develop, run and optimise successful digital marketing campaigns that generate leads and sales for your brand.

Our digital marketing services include:

- Strategic planning for social media and other digital marketing channels.

- Online advertising management and optimisation: Google Ads Search, Display, Re-marketing and social media advertising.

- Training: social media marketing training and digital marketing training.

- SEO strategy and execution. Including content development:articles, stories, eye-catching and SEO-optimised visuals.

- Celebrity and influencer marketing campaign strategy.

- Brand development. Logo creation, brand personality development and design of marketing materials.

- Consumer contests/competitions/giveaways.

- Email marketing. Dip sequence design and deployment.

- Conversion rate optimisation. It is also called “path to purchase” optimisation.

Contact us today and start boosting your leads and sales.

Hundreds of marketers have supported us with their generous donations. Please donate today! or join 5k+ marketers receiving our e-newsletter.

Final note: Want to reduce customer acquisition costs and dependency on paid media? eDigital‘s marketing strategy training will unmercifully review your marketing, help you build a marketing engine with channels and assets you own, stir your team’s thinking, bring new ideas for new conversion paths and boost customer lifetime value.

THE BIG MAC INDEX TABLE 2024 – THE ECONOMIST

Mau is one of the most popular marketing consultants offering the best marketing strategy training and the best social media training. Top marketers use Mau’s popular Digital Marketing Plan and Social Media Plan templates

Book Mau for your next training day or join 5k+ marketers receiving Mau‘s e-newsletter